Hedge Fund Indices: Benchmarks Trusted by Leading Institutions

In the complex world of alternative investments, hedge fund managers and institutional investors rely on clear, transparent benchmarks to measure performance. A strong benchmark is built on data integrity, governance, and industry coverage, all of which are key features of HFR’s hedge fund indices.

What Is a Benchmark?

Investors use benchmarks to compare performance and determine if an investment justifies its risk and cost. A well-designed benchmark reflects and investment’s main characteristics, including:

- Asset composition

- Risk level

- Investment time horizon

In this way, the benchmark represents an investment’s opportunity cost, or the return that could be earned elsewhere.

It’s important to distinguish between an index and a benchmark:

- Index: A broad, statistical measure of asset performance, such as the S&P 500

- Benchmark: A specific reference point used to evaluate a portfolio or strategy’s results, which can include indices or a customized portfolio

Role of HFR Benchmarks

HFR is recognized as a global authority in hedge fund indices. Leading fund managers, institutions, and wealth allocators, use HFR benchmarks because they meet the highest standards of transparency, compliance, and reliability.

These elements define a high-quality hedge fund benchmark:

- Investability

- IOSCO compliance

- Following EU benchmark regulation best practices

- S.A.M.U.R.A.I. framework adherence

HFR indices meet all four standards, ensuring accurate representation, strong governance, and dependable performance data.

Investable Benchmarks

An investable benchmark allows investors to allocate capital to a product that replicates its performance. This separates actionable benchmarks from theoretical models or arbitrary spreads.

Every HFR index family features investable versions, such as the HFRI 500 Fund Weighted Composite Index, that allow investors to test performance in real market conditions.

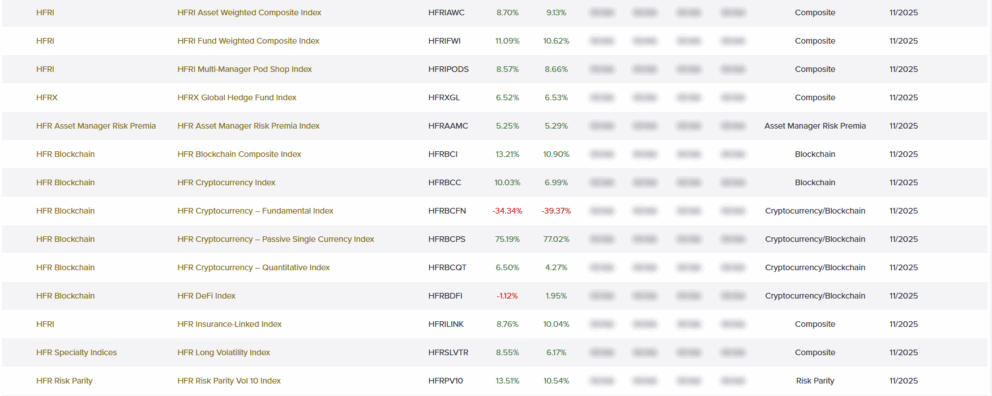

HFR produces more than 500 Indices. Browse and filter indices across a range of families and strategy types on HFR’s website.

IOSCO Compliance: The Global Standard

The International Organization of Securities Commissions (IOSCO) sets global standards for securities and futures markets, working closely with the G20 and the Financial Stability Board. HFR’s compliance with IOSCO principles ensures strict data integrity through:

- Documented Submitter’s Code of Conduct

- Robust conflict of interest policies

- Clear governance standards

Learn more on HFR’s IOSCO compliance policies: IOSCO Compliance Policies

EU Benchmark Regulation (BMR) best practices

The EU Benchmarks Regulation (EU BMR) is an EU-wide framework that sets rules for the administration and use of financial benchmarks. HFR adheres to EU Benchmark Regulation (BMR) best practices for the purposes of establishing common standards for the calculation and reporting of financial benchmarks.

S.A.M.U.R.A.I. Framework: CFA Institute Standards

The CFA Institute’s S.A.M.U.R.A.I. framework defines seven key traits of a high-quality benchmark

- Specified in advance: The benchmark is defined prior to the evaluation period.

- Appropriate: Consistent with the manager’s investment style or expertise.

- Measurable: Returns are readily calculable on a frequent basis.

- Unambiguous: Clear, transparent construction and calculation methodology.

- Reflective of current investment opinions: The manager has knowledge of benchmark constituents.

- Accountable: The manager accepts accountability for constituents and performance.

- Investable: It is possible to replicate or hold the benchmark.

HFR constructs its indices to follow all S.A.M.A.R.U.I. criteria, ensuring they are institutional-grade caliber.

Best Practices for Benchmark Selection and Due Diligence

When evaluating a hedge fund index, confirm it meets these best practice standards:

- Investability and real market representation

- IOSCO compliance with annual audits

- ESMA regulatory adherence

- A.M.U.R.A.I adherence

- Real-time data gathering and publication

- Annual Code of Conduct signed by all fund managers

- Quarterly board review

- Published methodologies and constituent information

- Formal approval process for changes

- Redundant calculation verification before publication

Following these steps help ensure that the benchmark you rely on is transparent, reliable, and properly governed. These qualities define HFR Hedge Fund Indices.