A Barometer of Hedge Fund Performance: The HFRI Hedge Fund Weighted Composite Index

High net worth investors have a sophisticated palette for risk and seek out market intelligence for portfolio allocation towards hedge fund investments. Equally, excellent portfolio managers use the best data available to assess current and future trends and forecast performance. The HFRI Fund Weighted Composite Index stands as a time-tested barometer of hedge fund industry performance.

For decades, the HFRI Fund Weighted Composite Index (HFRIFWC) has stood as the hedge fund industry’s leading benchmark, serving as a definitive measure of performance within the alternative investment industry.

Whether you are a hedge fund manager benchmarking your own performance or an institutional investor seeking diversification, the HFRIFWC offers the clarity required to navigate complex markets within an opaque industry.

Why the HFRIFWC is an Industry Benchmark

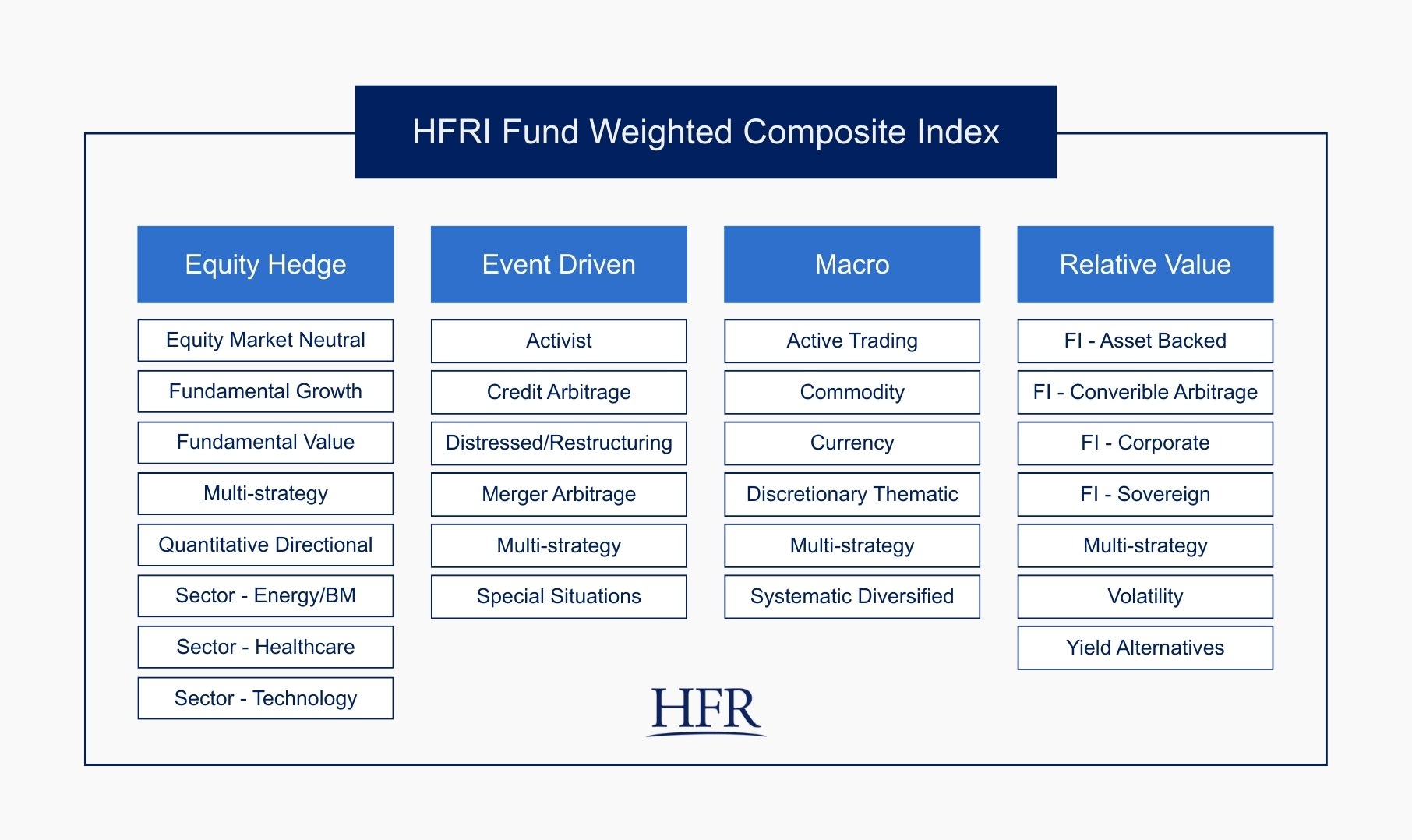

The HFRIFWC Index provides the most extensive representation of the hedge fund universe, as it includes more than 1,000 constituents. It is comprised of funds within HFR’s single-manager strategy classification system: Equity Hedge, Event-Driven, Macro, and Relative Value. The HFRIFWC specifically excludes Funds of Hedge Funds to better represent individual manager skill and prevent double-counting of fees and performance.

To ensure that data within the HFRIFWC remains relevant and indicative of the current environment, HFR requires managers to report monthly returns and rebalances the index annually. Furthermore, performance is calculated net of all fees so that the index reflects actual value realizable by investors.

The HFRIFWC’s credibility is rooted in the depth and breadth of its current and historical data: It has been tracking a multitude of strategies and managers within the hedge fund industry since 1990. Since the index has captured decades of data, it is a vital tool for modeling risk and return expectations over long time horizons.

Graph: The HFRI Fund Weighted Composite Index (HFRIFWC) is comprised of funds within HFR’s single-manager strategy classification system, highlighted in blue boxes in the graph above. Constituent sub-strategies included in the HFRI FWC Index are shown below each main strategy.

Graph: The HFRI Fund Weighted Composite Index (HFRIFWC) is comprised of funds within HFR’s single-manager strategy classification system, highlighted in blue boxes in the graph above. Constituent sub-strategies included in the HFRI FWC Index are shown below each main strategy.

Constituent Access

For insights beyond a high-level aggregate number, the HFRIFWC has its index constituents available for analysis within the HFR Database. Users can examine specific metrics for each constituent, including monthly performance figures, assets under management (AUM), strategy descriptions, and fee information. For preliminary due diligence, users can view a fund’s performance against funds in its peer group on a strategy and sub-strategy level.

All data within the database is exportable, so analysts and team members can seamlessly integrate the raw data into their own proprietary models and internal systems for bespoke analysis.

Live Updates

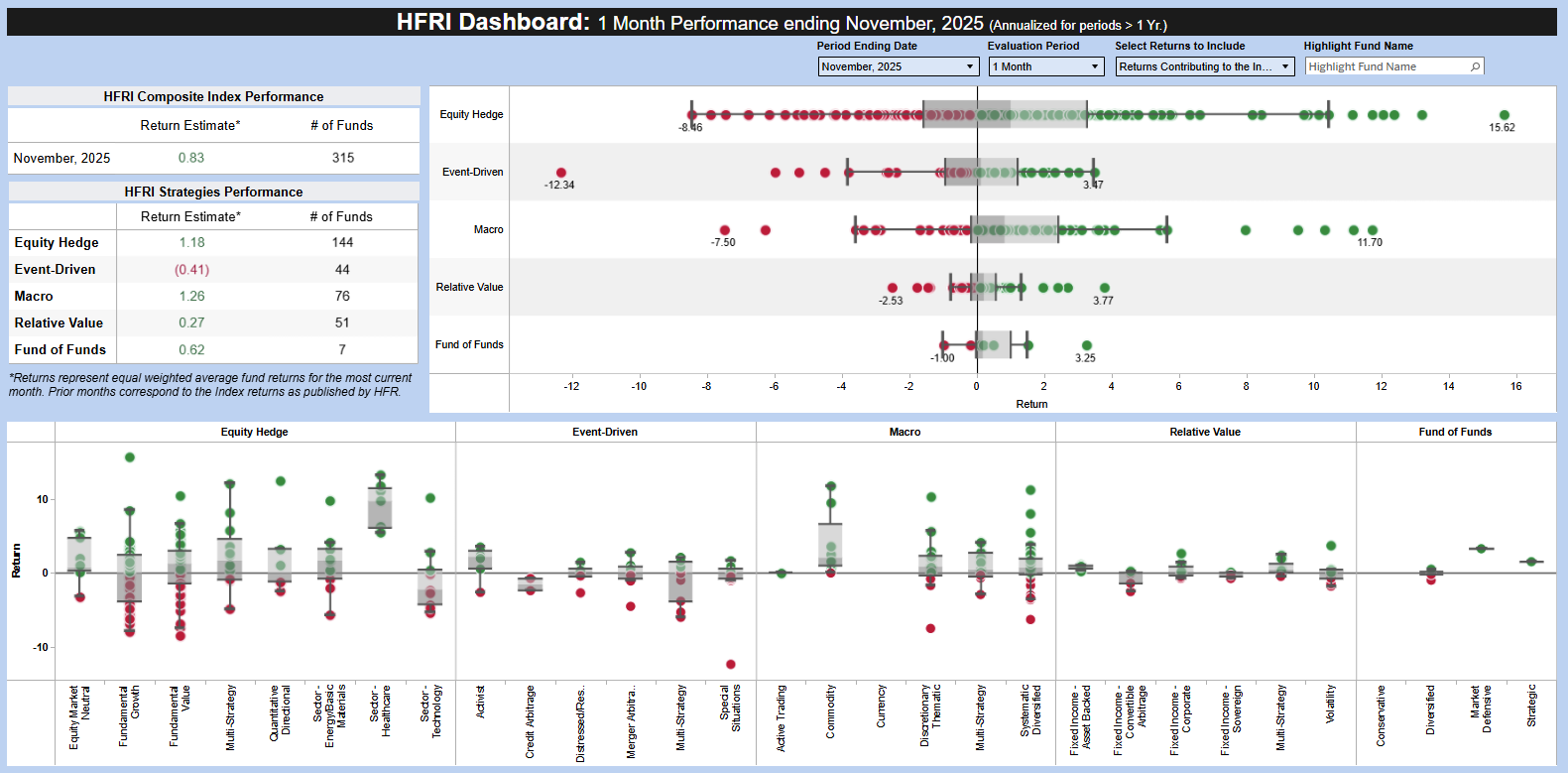

The utility of the HFRIFWC is amplified through HFR IndexScope, a proprietary platform that is designed to transform the index into a dynamic analytical tool. The platform provides comprehensive time-series and cross-sectional data from 2008 to the present, covering all funds within the HFRIFWC.

IndexScope offers a distinct tactical advantage for active market participants: users can leverage the platform’s live fund data updates to estimate performance before the HFRIFWC’s official release dates. The platform also allows for sophisticated dissections of the hedge fund industry, enabling users to access fund assets, firm details, geographic locations of funds, and performance dispersion.

Graph: A screenshot from IndexScope Live: HFRI Dashboard

Graph: A screenshot from IndexScope Live: HFRI Dashboard

What Moves the HFRI Fund Weighted Composite Index?

HFR prioritizes data transparency for users. Beyond providing top-line monthly performance value and underlying constituent data, the HFRIFWC also has contribution information available via the HFRIFWC Contribution Report. This report is a key tool for managers and allocators to quickly understand the index’s performance drivers each month. It breaks down returns by the index’s strategies and sub-strategies, as well as providing performance drivers by AUM, region, and liquidity.

For hedge fund managers, the report can provide necessary narrative context to explain performance to investors. For example, a manager could showcase how they outperformed the HFRIFWC despite a headwind in their sub-strategy sector.

Consider a scenario in which the HFRIFWC returns 1.8% in a given month. A look into the contribution report reveals that equity hedge strategies contributed 1.3% of this growth, while macro strategies created a drag. With this data, an investor can better evaluate a macro manager who returned 1.5% that month, potentially viewing the manager as a relative outperformer against a struggling peer group rather than an underperformer against the higher headline data.

The Foundation for Informed Hedge Fund Decisions

In an investment landscape defined by a lack of transparency, the HFRI Fund Weighted Composite Index serves as a strong baseline for truth. For a hedge fund manager, it provides context to define success and articulate value to clients. For the allocator, it provides a way to separate luck from skill.

The HFRI FWC provides a consistent, longstanding point of reference for allocators with institutional mandates, for high-net-worth individuals undertaking sophisticated analysis, and for fund managers pursuing any major strategy. Regardless of an individual’s or entity’s chosen use case, the value added by the HFRIFWC makes it an essential prerequisite for charting the hedge fund industry.

Learn more about the HFRI Fund Weighted Composite by scheduling a demo with our team at Contact | HFR.